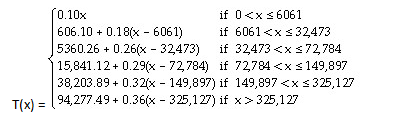

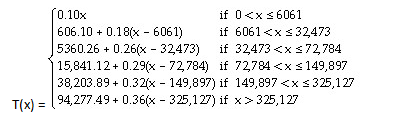

The following piecewise function gives the tax owed, T(x), by a single taxpayer on a taxable income of x dollars. How do you solve this?

The following piecewise function gives the tax owed, T(x), by a single taxpayer on a taxable income of x dollars.

(i) Determine whether T is continuous at 6061.

(ii) Determine whether T is continuous at 32,473.

(iii) If T had discontinuities, use one of these discontinuities to describe a situation where it might be advantageous to earn less money in taxable income.

The following piecewise function gives the tax owed, T(x), by a single taxpayer on a taxable income of x dollars.

(i) Determine whether T is continuous at 6061.

(ii) Determine whether T is continuous at 32,473.

(iii) If T had discontinuities, use one of these discontinuities to describe a situation where it might be advantageous to earn less money in taxable income.

1 Answer

See below

Explanation:

All the pieces are continous, since they are polynomials. So,

So, to answer (i), let's evaluate the first two pieces where

First piece:

Second piece:

The answer is yes,

As for (ii), it's the same thing, but with the second and third piece, and

Second piece:

Third piece:

And thus

This leads to (iii): it is better to gain, for example,