Why is there a deadweight loss from taxation?

1 Answer

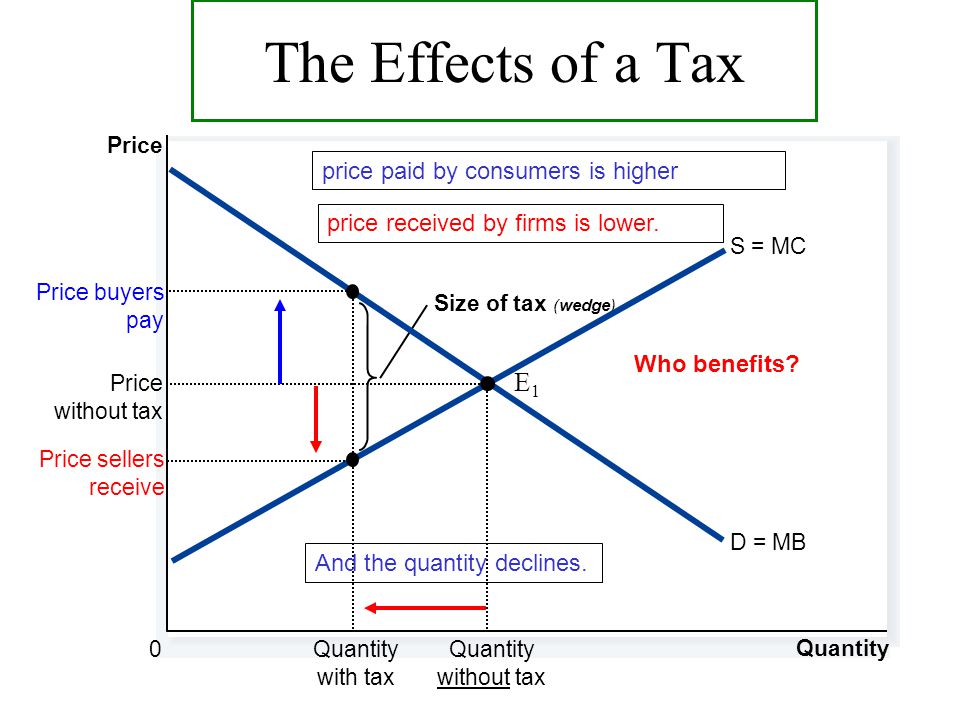

Deadweight loss results from the reduced equilibrium quantity after taxation -- potential gains from trade that the market no longer exploits for producer or consumer surplus.

Explanation:

I found an images that shows the impact of the tax wedge:

You can see the reduction in quantity. Unlike many other images, this graph does not shade the area that represents deadweight loss. However, the question focused on what causes deadweight loss -- and that's really the reduction in quantity. The size of the tax wedge is the other driver of deadweight loss.

Because deadweight loss is depicted in this graph (and most simple representations) as a triangle, we can compute the magnitude of deadweight loss as the area of the triangle (in the graph, bounded by the tax wedge and point E1):

DWL = 1/2 x Tax Wedge x Quantity lost after tax